8 Simple Techniques For Property By Helander Llc

8 Simple Techniques For Property By Helander Llc

Blog Article

Property By Helander Llc Things To Know Before You Get This

Table of ContentsLittle Known Questions About Property By Helander Llc.Some Known Details About Property By Helander Llc Examine This Report on Property By Helander LlcNot known Details About Property By Helander Llc Property By Helander Llc Things To Know Before You Get ThisSome Ideas on Property By Helander Llc You Need To Know

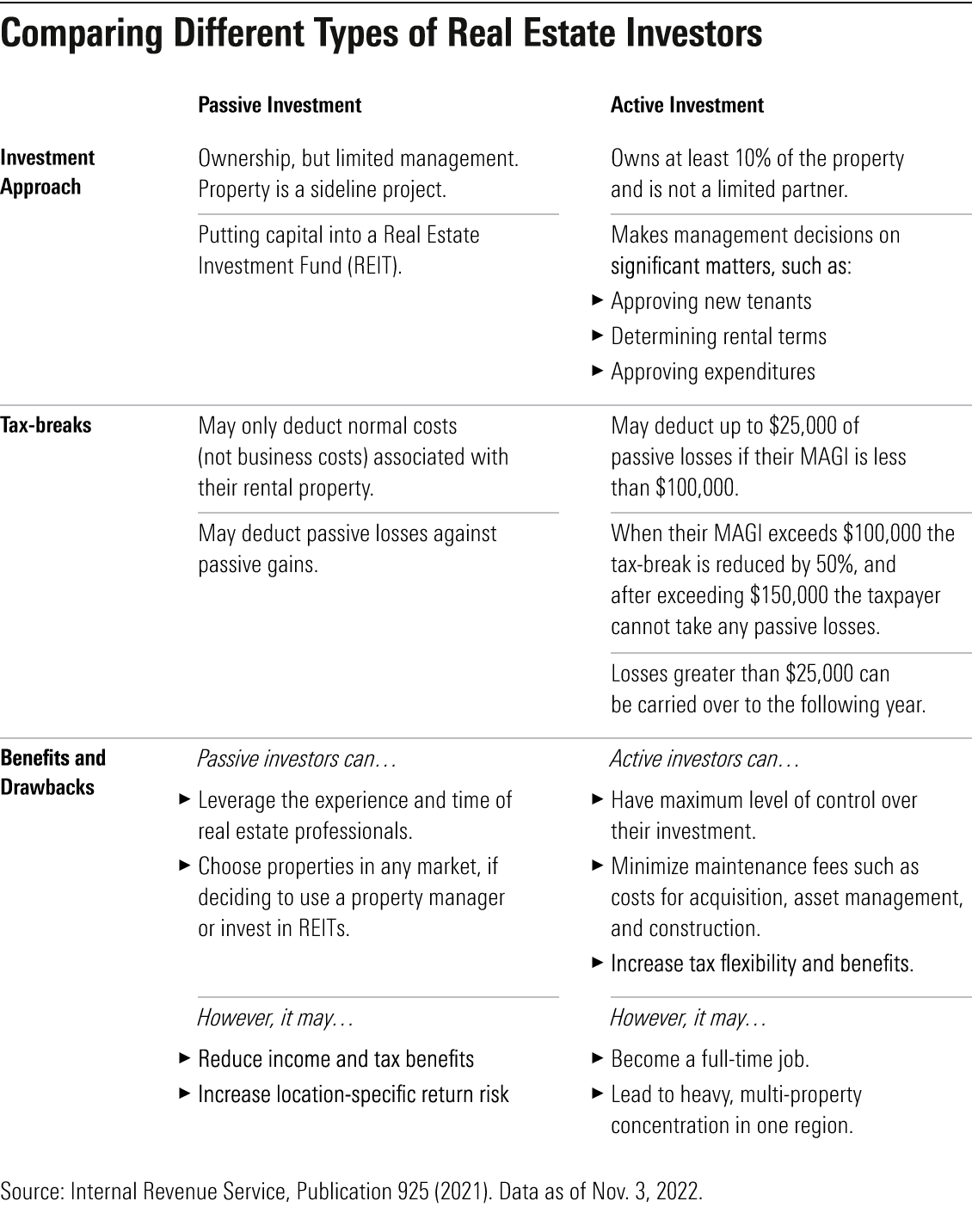

The advantages of spending in real estate are many. Right here's what you require to understand concerning genuine estate advantages and why actual estate is taken into consideration a good financial investment.The advantages of investing in actual estate include easy income, steady cash flow, tax obligation benefits, diversity, and utilize. Real estate financial investment trusts (REITs) use a means to invest in real estate without having to possess, run, or finance homes.

In many situations, cash money flow just strengthens over time as you pay down your mortgageand accumulate your equity. Investor can make the most of countless tax breaks and reductions that can save money at tax obligation time. Generally, you can deduct the practical expenses of owning, operating, and taking care of a residential or commercial property.

The Of Property By Helander Llc

Realty worths tend to boost over time, and with a great investment, you can profit when it's time to sell. Rents also tend to climb with time, which can bring about greater money circulation. This graph from the Reserve bank of St. Louis shows mean home prices in the united state

The locations shaded in grey suggest united state recessions. Typical Sales Cost of Houses Sold for the USA. As you pay down a residential or commercial property mortgage, you construct equityan possession that's part of your web worth. And as you build equity, you have the utilize to purchase even more buildings and increase capital and wealth a lot more.

Due to the fact that actual estate is a concrete property and one that can function as security, funding is easily available. Realty returns vary, depending on aspects such as place, property course, and administration. Still, a number that lots of capitalists go for is to beat the typical returns of the S&P 500what many individuals describe when they claim, "the market." The inflation hedging capacity of property originates from the favorable relationship in between GDP development and the demand genuine estate.

The 10-Second Trick For Property By Helander Llc

This, in turn, converts right into higher capital values. Therefore, realty has a tendency to keep the buying power of funding by passing several of the inflationary stress on to occupants and by incorporating a few of the inflationary stress in the kind of funding admiration. Home mortgage borrowing discrimination is prohibited. If you think you've been differentiated versus based upon race, religion, sex, marriage status, use public aid, national beginning, handicap, or age, there are actions you can take.

Indirect genuine estate spending includes no straight ownership of a residential property or residential properties. There are several methods that owning genuine estate can protect versus rising cost of living.

Ultimately, homes funded with a fixed-rate lending will see the relative amount of the month-to-month home loan settlements tip over time-- as an example $1,000 a month as a set payment will become less troublesome as rising cost of living deteriorates the acquiring power of that $1,000. Typically, a primary residence is ruled out to be an actual estate financial investment since it is used as one's home

Getting The Property By Helander Llc To Work

Even with the help of a broker, it can take a few weeks of job simply to locate the appropriate counterparty. Still, actual estate is an unique possession class that's straightforward to recognize and can improve the risk-and-return profile of an investor's profile. On its own, property uses capital, tax obligation breaks, equity building, competitive risk-adjusted returns, and a hedge versus rising cost of living.

Purchasing realty can be an incredibly fulfilling and financially rewarding venture, but if you resemble a great deal of brand-new financiers, you might be questioning WHY you should be spending in realty and what advantages it brings over other financial investment opportunities. In enhancement to all the amazing benefits that come with investing in property, there are some disadvantages you require to think about too.

Some Known Details About Property By Helander Llc

If you're searching for a method to acquire into the property market without having to spend numerous hundreds of bucks, have a look at our homes. At BuyProperly, we utilize a fractional possession version that enables financiers to begin with just $2500. Another significant advantage of actual estate investing is the ability to make a high return from buying, remodeling, and reselling (a.k.a.

A Biased View of Property By Helander Llc

If you are billing $2,000 rental fee per month and you sustained $1,500 in tax-deductible expenditures per month, you will just be paying tax on that $500 revenue per month (sandpoint idaho realtors). That's a large difference from paying tax obligations on $2,000 each month. The revenue that you make on your rental for the year is taken into consideration rental revenue and will certainly be tired as necessary

Report this page